h/t to Award Wallet for flagging this one for me early!

Chase has revamped their popular Ink Cash business card, offering a more enticing rewards structure for budget-conscious entrepreneurs. Let’s jump right into the details to see if this card deserves a spot in your wallet (spoiler: it absolutely does!).

Already know this is the card for you? Click the button below and fill out your name and email to get our custom, easy to follow guide sent directly to your inbox.

Basic Features of the Chase Ink Cash (CIC)

The Chase Ink Cash is a fan favorite among us who value Chase UR points above almost all other points. The card not only offers a generous sign up bonus for new customers, but it has an incredibly attractive bonus category that can be leveraged with Staples Office Supply store’s fee-free Visa Gift Card promos.

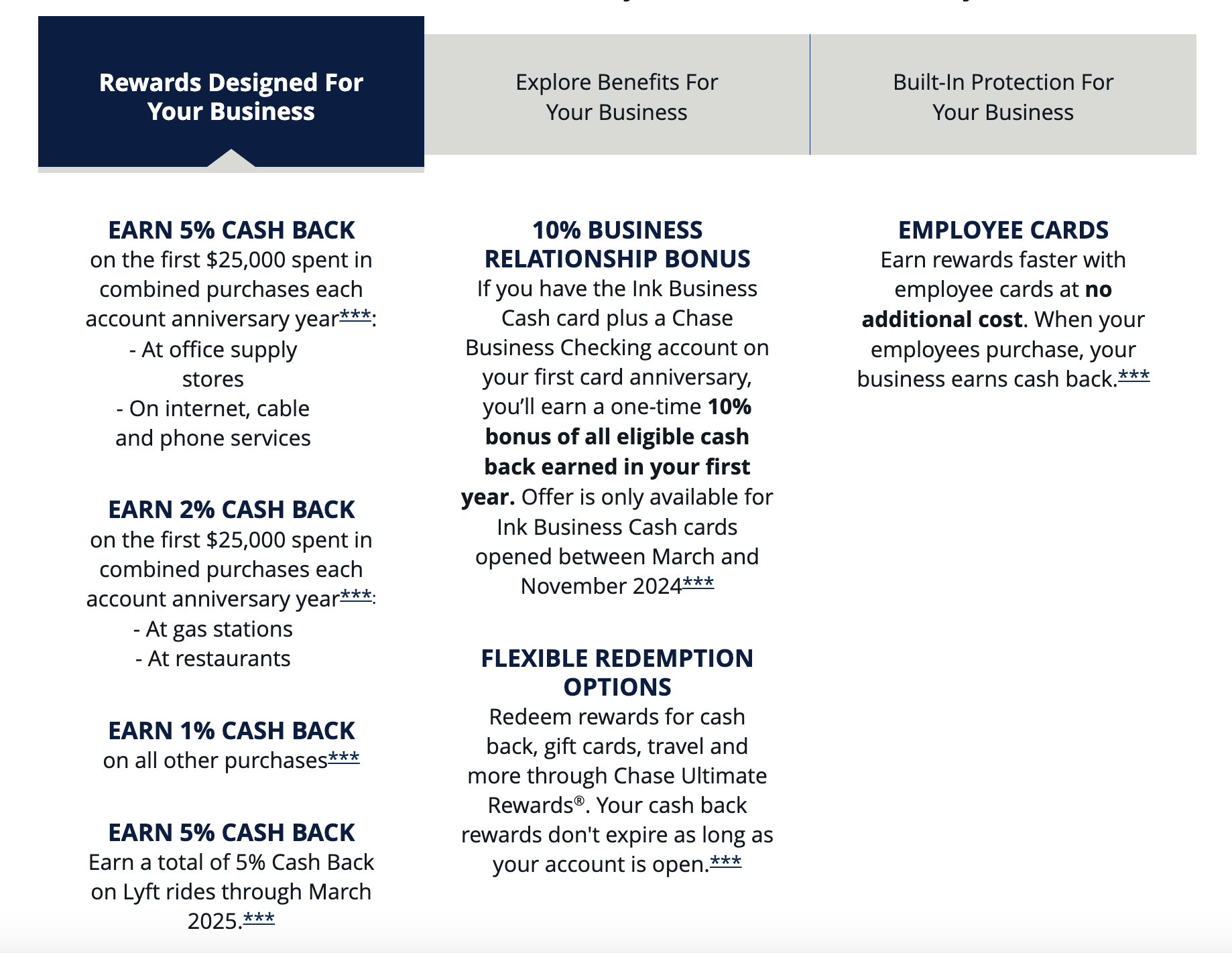

Generally speaking, here are the basics of the card:

- Card Type: Business Credit Card (Not sure if you’ll qualify as a business? Schedule a consultation with thePointsPage to find out, or request our email guide below – 99% of people qualify, btw)

- Rewards: Chase Ultimate Rewards (can be converted to cash back)

- Annual Fee: $0

- Foreign Transaction Fee: 3%

- Promotional Purchase Interest Rate: 0% for the first 12 months

- Balance Transfer Fee: 5% of each transferred amount ($5 minimum)

- Bonus Categories: 5x at Office Supply Stores, Internet, cable, and Phone; 2x at gas stations and restaurants.

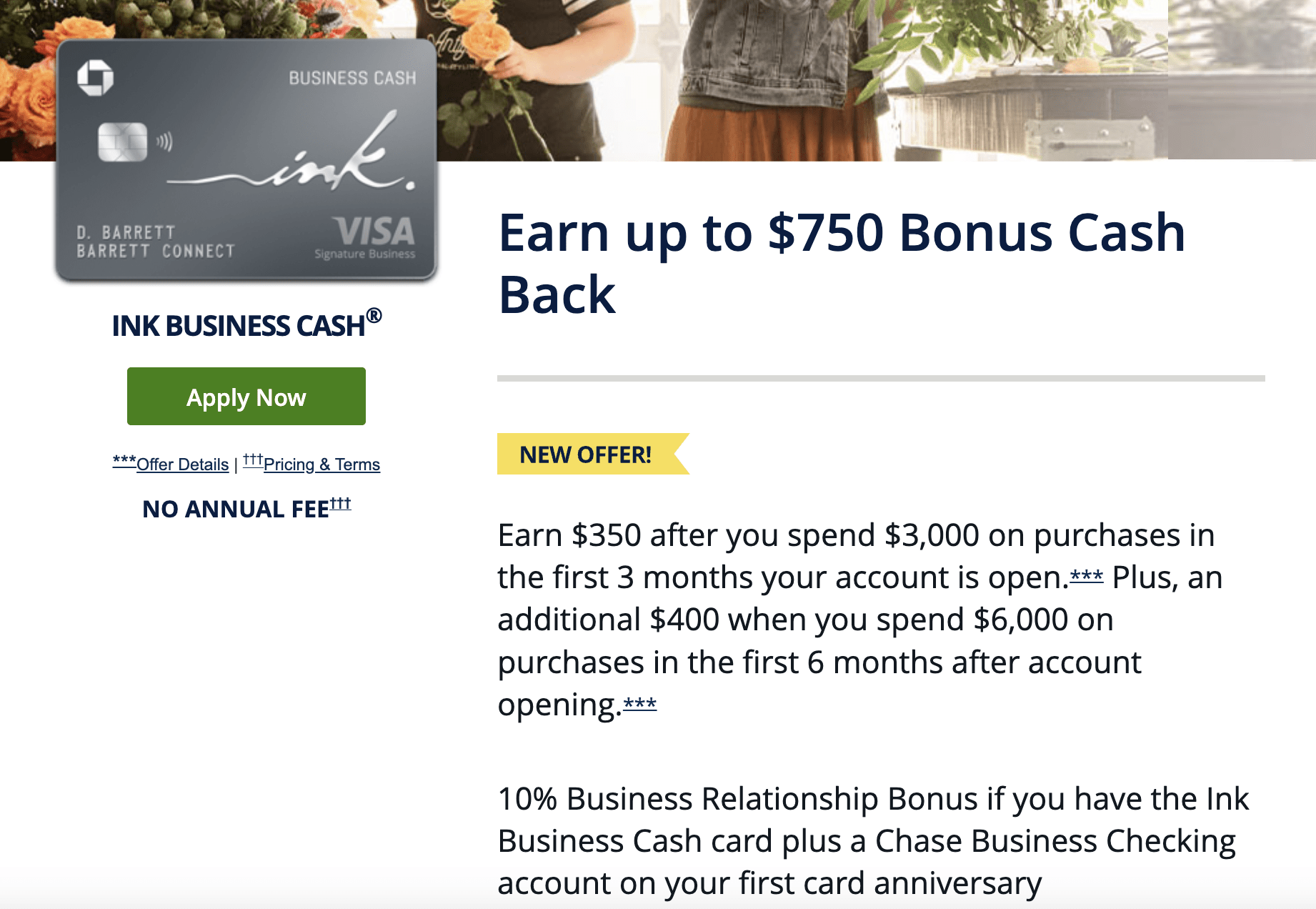

Tiered Welcome Offer + 10% Annual Bonus

Alright, now with that out of the way, let’s get to the new details. I hope you’re already as excited about this as I am, because this offer is incredible!

The new Chase Ink Cash boasts a tiered welcome bonus, rewarding you based on your spending in the first 6 months:

- Spend $3,000 within 3 months: Earn a respectable 30,000 Chase UR points (or convert it to $300 cash back).

- Spend another $3,000 in 3 more months: Unlock the maximum bonus of 75,000 Chase UR points (or $750 cash back).

It’s important to understand that the $6k spend can be completed as quickly as you’d like to spend it, but you have a total of up to 6 months to get it done. No need to spend $3k, wait 3 months, then spend another $3k.

This tiered system caters to businesses with varying spending power, and is already head and shoulder above the standard $6k/75k UR bonus we’ve seen on this card in the past. Whether you’re just starting or a seasoned entrepreneur, there’s a welcome bonus within reach. And, I hate to do it, but call me Ron Popeil because “WAIT! There’s more!!“

10% Cash Back Relationship Bonus - A Rewarding Loyalty Perk

This is where it gets really wild. Chase is introducing a new 10% bonus on all the cash back you earn in your first year with the card as long as you have a Chase Business Checking account to pair with your card. As if you needed any more motivation to open up this checking account, there’s a sign up bonus for that, too! Open your account before April 18, 2024 for up to a $750 cash bonus.

When you have both accounts open, this relationship bonus essentially gives you 1.1% cash back on all your purchases for the first 12 months and is a fantastic way for Chase to reward loyal cardholders and incentivize continued use. To qualify, the terms state you just need to have both the Ink Card and the Business Checking Account opened by the time the 1-year card anniversary rolls around. This should give you plenty of time to get your docs together to present to Chase to open the checking account.

Running some quick numbers we can see that if you were to max out your Staples VGC and Office Depot MCGC plays for the year, you’d earn 135,750 Chase UR points without having to pay any fees. Like I said, absolutely wild.

Need to Learn How to Apply for a Business Card?

If you’re like a lot of the new travel hackers in the game, you may be thinking that business credit cards are unattainable for you. Well, good news, the overwhelming majority of people we talk to qualify as a business owner for the purposes of obtaining a business credit card like the Ink Cash.

Do you ever occasionally sell used, household items on Facebook Marketplace? Craigslist? Etsy? Shoot, at a garage sale once a year? If so, then congrats, because you’re likely qualified for one of these business cards.

The application process isn’t the same as a normal personal card, however, so you’ll need a few pointers to get you through it without throwing up any red flags once you submit. Fill out the form below with your name and email and we’ll send you our custom, easy to follow guide so you can learn exactly how to apply for your best odds of approval.

To receive the guide, be sure to check your inbox and spam folder for our confirmation email!

Is the New Chase Ink Cash Right for You?

Easy answer? Yea, probably. I’d say this card makes a great addition to anyone’s wallet who’s currently under 5/24 (not sure what this mean? Read about it here). This revamped card shines for small businesses that value:

- Straightforward UR Earnings: With just the right number of bonus categories, tracking your points earning is easy.

- Flexibility: The tiered welcome bonus caters to businesses with varying spending power who may not be able to hit the traditional $6k spend in 3 months.

- Rewarding loyalty: The 10% cash back bonus in the first year for those that have a business checking account is a sweet perk for committed cardholders.

- Cost-effectiveness: The fact that this card still has no annual fee keeps your business expenses in check.

Getting to the Point

The new Chase Ink Cash offers a compelling package for budget-conscious business owners. The tiered welcome bonus, coupled with the 10% relationship bonus for those with a Chase Business Checking Account, makes it easier to earn substantial cash back in the first year. With no annual fee to worry about, the Chase Ink Cash remains a strong contender in the cash back business card arena.

Ready to apply but need a little help to learn how to complete the application? Fill out the form above and we’ll send our custom, easy to follow guide right to your inbox with everything you need to know!