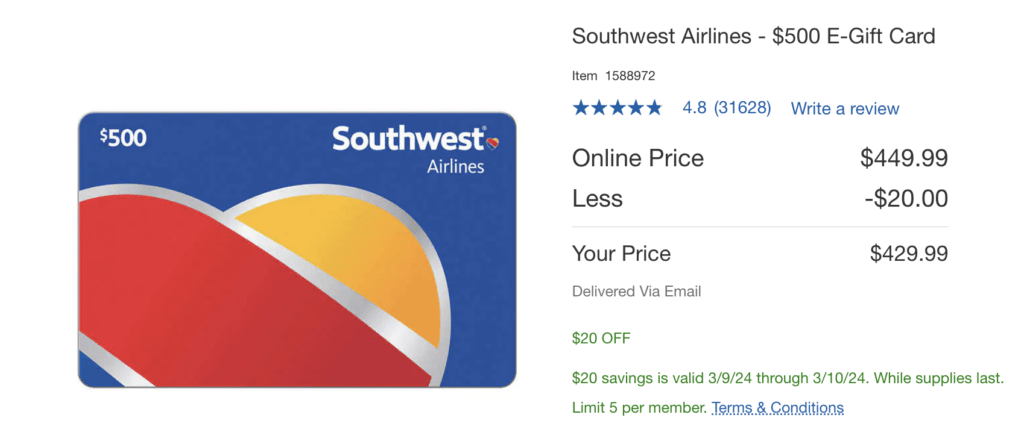

There’s a limited-time offer at Costco that can help you save on your next trip. Until end of day today, March 10th, 2024, Costco members can snag a $500 Southwest Airlines e-Gift Card for just $430. That’s a sweet $70 discount compared to the face value!

Here's What You Need to Know:

- Discount: Save $70 on a $500 Southwest Airlines e-Gift Card

- Price: $430 (originally $500)

- Availability: Today only (March 10th, 2024) or while supplies last; purchase online

- Purchase Limit: 5 per Costco membership

- Delivery: Electronic (delivered via email)

Important Rules to Consider:

- This offer is exclusive to Costco members. A valid membership is required for purchase.

- The discounted price of $430 applies only to e-Gift Cards purchased online at Costco’s website. In-warehouse pricing may differ.

- The gift card has no expiration date, so you can use it for future travel plans.

- The gift card amount can be redeemed towards any Southwest Airlines flight, including online bookings, phone reservations, and airport ticket counters.

- Gift card funds cannot be refunded.

Maximize Your Savings

Even though most of us read blogs like this one to learn how to earn and stretch points and miles, deals like this are hard to pass up. This discounted gift card is a great way to get more bang for your buck if you’re a frequent (or, heck, infrequent) Southwest traveler.

To make the best of your shiny new gift card, here are some tips to maximize its value:

- Plan your trip: Check your existing travel plans and see if there’s a Southwest flight you can take instead. If you have upcoming travel plans on Southwest, you can always cancel and rebook using the gift card to save a few bucks.

- Pool funds: If you’re traveling with a group, you and your companions can combine your Costco memberships to purchase the maximum of 5 gift cards per membership (up to 25 total).

- Consider future travel: Since the gift card doesn’t expire, you can use it for a future Southwest trip you haven’t booked yet.

Which Credit Card to Use

The price savings on the deal itself make this a worthwhile purchase even with a debit card, but let’s take a look at a few different credit cards that would get you even more value.

Sign Up Bonus: 75,000 Capital One Miles

Minimum Spend: $4,000 in 3 months

Annual Fee: $395

The Capital One Venture X is a premium travel card with a $300 annual travel credit and annual 10,000 point bonus. It offers a generous rewards program, including a 75,000-mile welcome bonus and 2x miles on all purchases. The travel booking portal is also considered one of the best available for consumer bookings.

Beyond points and miles, Venture X cardholders unlock a world of travel comfort and convenience. Relax in airport lounges worldwide, enjoy statement credits for travel bookings, and gain valuable benefits like travel insurance and Global Entry / TSA PreCheck fee credit.

The Venture X Visa is one a premium card offered by Capital One with a generous sign up bonus, and easy to navigate earn categories. For all your normal, everyday purchases at every location you’ll earn a flat 2x miles per dollar spent. Leverage these miles best by moving these to the Capital One transfer partners for incredible business class flights and spacious vacation rentals through the Wyndham partnership with Vacasa.

Sign Up Bonus: 20,000 Chase UR

Minimum Spend: $500 in 3 months

Annual Fee: None

The Chase Freedom Unlimited offers a flat 1.5% cash back on all purchases, with bonus categories for dining, drugstores, and travel booked through Chase. With no annual fee, it’s a solid everyday spending card for those who prioritize cash back over travel points.

Beyond cash back, the Chase Freedom Unlimited boasts valuable perks like travel and purchase protections, a complimentary year of DashPass, and mobile wallet compatibility, making it a convenient and secure choice for everyday spending.

If the Capital One ecosystem isn’t your thing yet, stick with the tried-and-true Chase Ultimate Rewards system instead. You’ll earn a flat 1.5x Chase UR points for every dollar spend with this no annual fee card.

Sign Up Bonus: $2,000 Cash Back

Minimum Spend: $30,000 in 3 months

Annual Fee: $150 (Can be refunded every year after spending $150k annually)

The Capital One Spark 2% Cash Plus is a credit card that offers unlimited 2% cash back on all purchases and a generous welcome bonus of up to $3,000 (limited time offer expiring March 11, 2024). It has no foreign transaction fees and rewards never expire. This card is a good option for businesses that prioritize simplicity and value straightforward cash back.

The Spark 2% Cash Plus sweetens the deal with perks like free employee cards, flexible spending limits, and easy vendor payments. This simplifies expense management and empowers your team.

If you’d rather earn some more cash back in your pocket, this limited-time offer from the Capital One Spark 2% Cash Plus Mastercard might be an option to consider. Even though Costco’s policy is only to accept Visa cards in-store, they’ll allow you to pay with a mastercard online or through their app, and with the heft $20k/$100k minimum spend on this card, this loophole to the rule can be quite valuable while you work on the $3k cash sign up bonus.

Getting to the Point

Overall, this limited-time offer at Costco presents a significant saving opportunity for Southwest Airlines flyers. If you’re a Costco member and have upcoming travel plans, or simply want to lock in a good deal for future Southwest flights, this discounted gift card is definitely worth considering.

Remember, this offer is valid only until today, March 10th, 2024, or while supplies last.