The ability to earn endless sign up bonuses and referral opportunities don’t exist for everyone, but building your points and miles balance is always at the top of the to-do list for those of us with unquenchable wanderlust.

Long-term players in this hobby know it already, but leveraging bonus categories and stacking credit card offers with shopping portal rewards is a fundamental strategy to make sure your transferable currencies aren’t running too low before the next trip.

The idea is simple, but execution has been flawed by way of too many tools and services providing only part of what we really need from them, causing the user to seek out 2 or 3 different free and paid services to fill a gap that a single one should be able to.

So today, let’s talk simplicity.

What Exactly is Savewise?

Before I jump into the why of Savewise, let’s talk about what it actually is first.

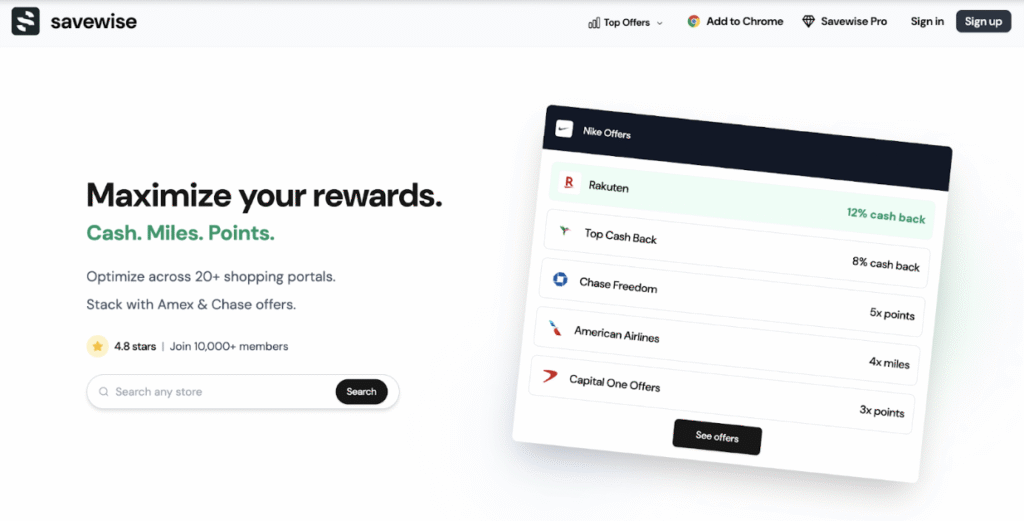

To start, think of Savewise not as a shopping portal itself, but as a smart aggregator and comparison tool. Its main job is to show you – in one place – the different rewards rates offered by various online shopping portals for a specific merchant.

Typically you’d need to visit a site like EVReward, CashBackMonitor, or Rakuten to get a feel for which online or brick-and-mortar stores were offering big discounts or cash-back opportunities first, then search your online banking offers for credit card deals, add the offers, click the links, track the sale, and finally see your extra rewards post down the road at some point…

It’s a lot.

While this new tool doesn’t roll up every piece of that process into one neat, tidy little package, it does pare down an extra step or two to streamline your workflow and help you identify offers that you may have missed otherwise.

Next up, looking beyond its ability to simply compare portal rates, its standout feature is integrating and highlighting opportunities to stack these earnings with credit card linked offers from Amex and Chase Offers. Instead of using yet another tool like Cardpointers to identify and add those offers, you can have Savewise handle this task, too.

Fewer portals to navigate = more time for you to earn points and miles.

The Perfect Combination

The tools that are out there now are great and there’s no sense in arguing that they aren’t. Their UI’s are easy to navigate, they pull relevant information, offer custom notification options, and ultimately help us earn more points to feed this wonderful little travel addiction we all have.

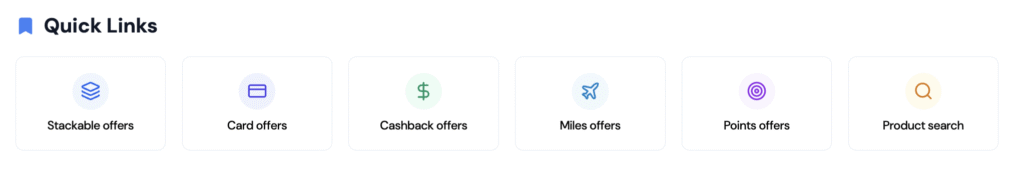

So, the great thing about Savewise is that it isn’t trying to reinvent the wheel, necessarily, but bring together the best components of these tools in an easier to use, more functional, and modern looking package. Aside from bringing us out of the stoneage with the updates to the user experience, there are a few key components to focus on:

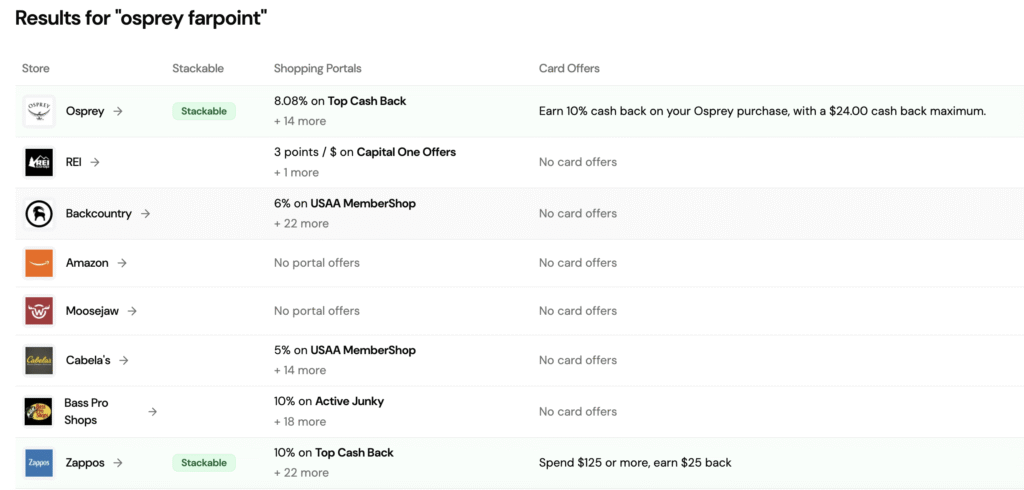

- Portal Comparison: When you search for a store (e.g., Nike, Best Buy, Sephora) on the Savewise website or via its browser extension, it pulls up the current cashback percentages or points / miles per dollar offered by over 20+ different shopping portals (like Rakuten, airline portals, Capital One Shopping, etc.).

This allows the user to quickly and easily compare multiple sites, offers, specials, referral opportunities, and earn rates at a glance, then directly navigate to the proper portal to make your purchase.

- Card-Linked Offer Integration: If you create an account (even a free one), you can sync your American Express and Chase accounts to import all of your offers to a single source page within Savewise. The tool will then automatically identify and highlight relevant Amex or Chase Offers available at the merchant you’re viewing, or offer a pop-up on your screen when browsing a website directly.

The ability to auto-add all Amex and Chase offers to your online banking accounts with a single click (which is also a perk recently added to the American Airlines SimplyMiles portal) is also available, but only for paid Pro memberships. This makes identifying “stacking” opportunities (using a card-linked offer plus earning through a portal) incredibly easy.

- Browser Extensions: To simplify things even further, Savewise offers a browser extension to help you identify deals even easier. Rather than have to navigate to the website, type in your online shopping destination and see what’s available, you can rely on the on-screen pop-up in real time as you visit websites.

This isn’t new, but this stand-out feature is: the card-linked offers we previously mentioned will also activate on that little pop-up. So, if you have an Amex or Chase Offer that applies to the website you’re visiting, you’ll be able to get notified in real time just like with shopping portal earn rates. Pretty cool! - Product Search: Another great feature is the ability to search for the actual item you’re looking to purchase, then have a list of vendors pop up along with their earn rates through all sorts of various shopping portals. This can be a useful tool for discovering new vendors that you didn’t know sold the products you were looking for. Why is that helpful? Well, maybe you have an Amex Business Platinum card Dell credit to burn but didn’t know they sold, I dunno, Nintendo Switch games. By searching for ‘Mario Kart’ in the Savewise search bar, you just learned a new way to redeem your Dell credit!

It’s these 4 features that really make Savewise stand out against its peers, and what give it the advantage when compared to the current options available.

Who is this For?

I personally feel that shopping portals are useful for everyone, but here are some of the key users I think would benefit the most:

- Avid Online Shoppers: Anyone who regularly makes purchases online can benefit from ensuring they’re getting the best return. Many of us aren’t even using standard portals for our everyday purchases, so jumping in to a platform that lets you hit the ‘easy button’ right from the get-go reduces the barrier to entry significantly.

- Points & Miles Maximizers: If you actively manage Amex / Chase Offers and use shopping portals, Savewise significantly simplifies finding stacking opportunities. Not having to constantly log in to search your current offers and match them up with stores is one heck of a time saver.

- “Stackers”: People who love combining multiple offers (portal + card-linked offer + credit card bonus categories) will find this tool streamlines the process significantly.

- Comparison Shoppers: Even if you only use one or two portals, Savewise helps ensure you aren’t missing out on a much better rate elsewhere.

Even if you don’t find yourself nestled neatly within one of these niche boxes, I’m guessing you’d still come away with an appreciation for this app after give it a whirl once or twice. The upside based on the ease of the use is tremendous.

How to Get Started

You’ve read all about the perks, features, and differentiators, and now you’re ready to give this thing a try for yourself (right?).

Getting set up with Savewise is straightforward. Your first step is to head over to their official website, GetSavewise.com. Right away, you can begin searching for your favorite stores to see the current portal offers, giving you an immediate feel for how the tool works.

However, to really unlock its potential, especially the valuable card-linked offer syncing, you’ll want to create an account – you can start with the completely free Basic plan or opt for the feature-rich Pro version.

- Basic (Free): Includes portal comparison (23+ portals), 14-day offer history, syncing Amex / Chase Offers, identifying stackable offers, browser extension access, and saving favorite merchants.

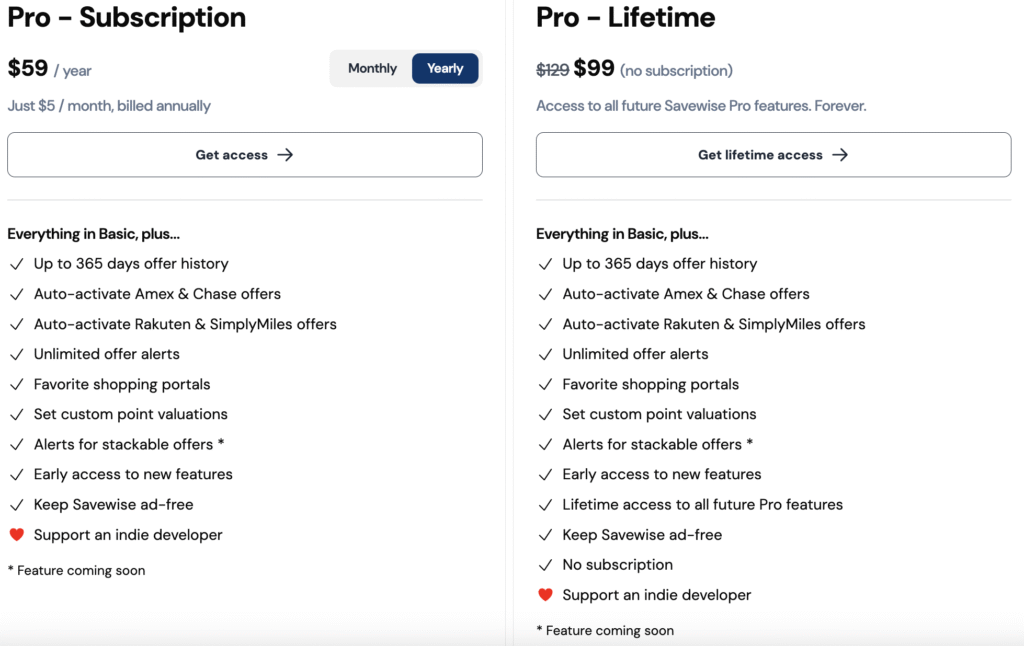

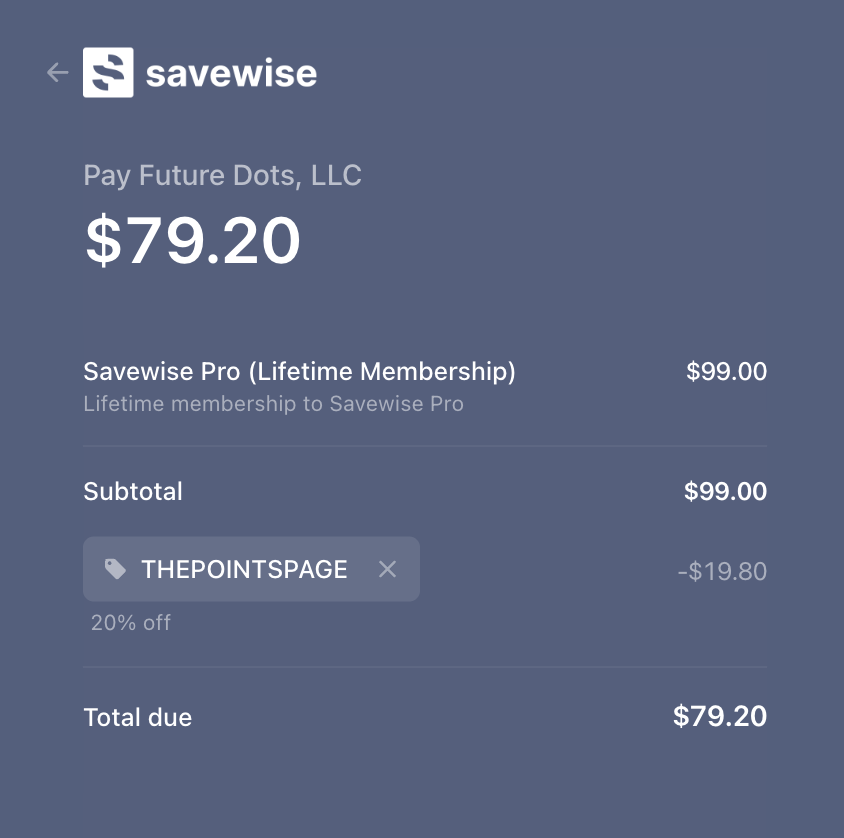

- Pro ($8/month or $59/year): Adds extended offer history (up to 270 days), auto-sync/activation for offers (including SimplyMiles), custom point valuations, and offer alerts.

- Pro Lifetime ($99): All the same great perks and features as the Pro subscription with no subscription fees.

For the most seamless experience, we highly recommend installing the Savewise browser extension, available for popular browsers like Chrome, Firefox, and Safari. This add-on works quietly in the background, automatically alerting you to deals as you browse different retail sites.

If you’re interested in signing up for a Pro account with Savewise, you can click here to use the promotional code THEPOINTSPAGE and receive an instant 20% discount on all their plans.

Once your account is set up, the final step for maximum benefit is to securely syncronize your American Express and Chase offers by logging into your accounts. This allows Savewise to spot those crucial stacking opportunities ensuring you never miss out on extra savings or points.

Getting to the Point(s)

In the world of points and miles, every point counts!

While Savewise won’t track your hard-earned balances (yet!), it excels at making sure you don’t leave rewards on the table when shopping online. By efficiently comparing portal rates and highlighting valuable card-linked offer stacks, it automates and simplifies a key part of the points-earning strategy. For anyone serious about maximizing rewards from online spending, Savewise is definitely a tool worth checking out.

Happy shopping (and earning)!