For those of us deep in the world of travel rewards and credit card points, the “5/24 rule” is a well-known gatekeeper. This unofficial, yet crucial, policy by Chase dictates that you won’t be approved for most of their valuable co-branded and Ultimate Rewards-earning credit cards if you’ve opened five or more credit cards (from any bank) in the past 24 months.

Interested in all the nitty gritty details about 5/24 and how they’ll affect your credit card and travel strategy? Read our in-depth post about what it is, why it’s important, and how to manage your applications to get the most bang for your buck.

How to Keep Track of your 5/24 Score

Well, we’ve got the easy way, and we’ve got the hard way. I don’t know about you, but when presented with the easy-options that’s usually the one I’m gravitating towards. But hey, let’s start with the hard way, first.

Tracking it the Hard Way

My tried-and-true method for determining my 5/24 score in the past has always been to use Credit Karma and look at each and every account in my credit report to determine the date which they were opened. This was a painstaking exercise, as their UI was less than user-friendly, and it meant digging deep into every. single. card. listed on your report to rule out which ones were older than 2 years. You can read more about how we recommended doing this from our Tools of the Trade page here.

Aside from 5/24 tracking, Credit Karma does have some pretty great perks and offers an easy way to keep an eye on your open accounts and inquiries. I’d still say it’s worth keeping on deck to stay current with your strategy.

Tracking it the Easy Way

When I first stumbled across this method, I was blown away at how quick, easy, and (mostly) intuitive the whole process was. This method took the time needed to track your 5/24 number from about 20-30 minutes or so, down to maybe 5. Seriously, it’s that simple.

The long and the short: you download the Experian mobile app to your phone (yep, has to be the app and not the website), you navigate to your credit card accounts, then simply tap the filter button to list them from newest to oldest.

Let’s dive in to exactly what that looks like below:

Initial Setup of the Mobile Experian App

While not difficult, there are all sorts of different apps out there that may come close to the same name as you’re searching, so let’s get rid of the uncertainty and just go straight into a step-by-step tutorial.

Step 1 - Search and Download the App

Easy enough, right? If you’re using a Google OS, head to the play store and search for “Experian app”. If you’re using an iOS device, the AppStore is where it’s at.

Click, download, open.

Step 2 - Create a Free Account

Once you’ve got the app downloaded, you want to set up a free account with them. You can use a generic email and password to get set up, or use the 2-click ‘Sign in with Google’ option to make things a little easier.

Be aware that they have some sneaky ways to get you to pay for their premium service, so pay close attention and don’t provide any credit card info for any kinds of ‘free trials’ or the like. It’s not necessary for what we’re trying to do.

Step 3 - Navigate to your Reports and Data Section

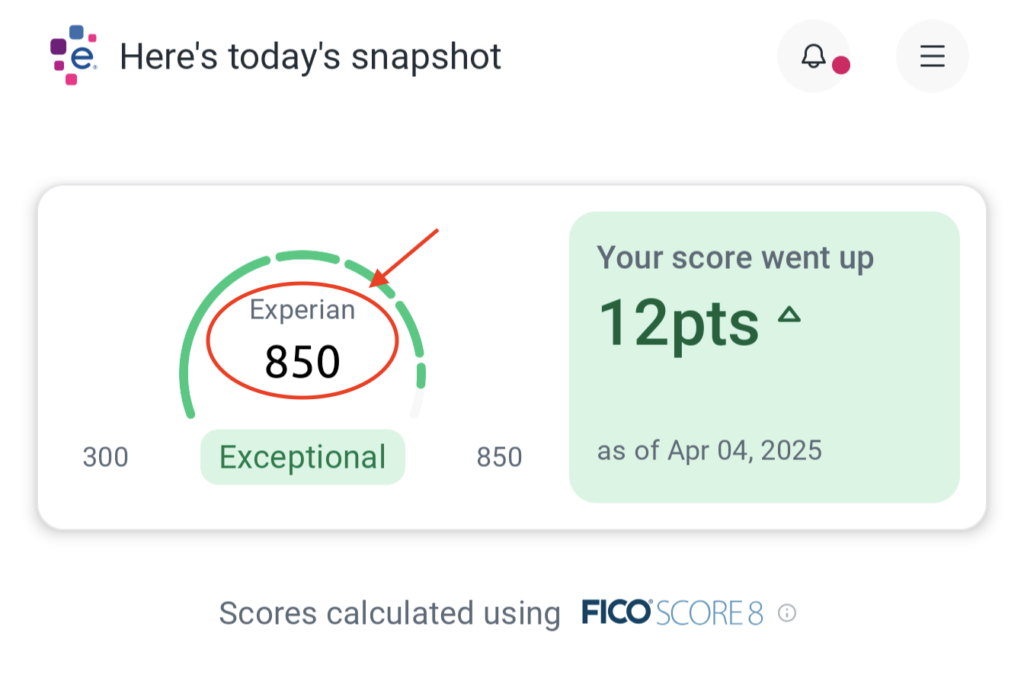

Once you have your account set up and are logged in, you’ll have quite a few different sections to click across to review all sorts of credit-related content.

What you’re looking for specifically at this point is the area showing your current credit score in the middle of a power-up meter type of image. Tap on the number and you’ll head to the next section of the app.

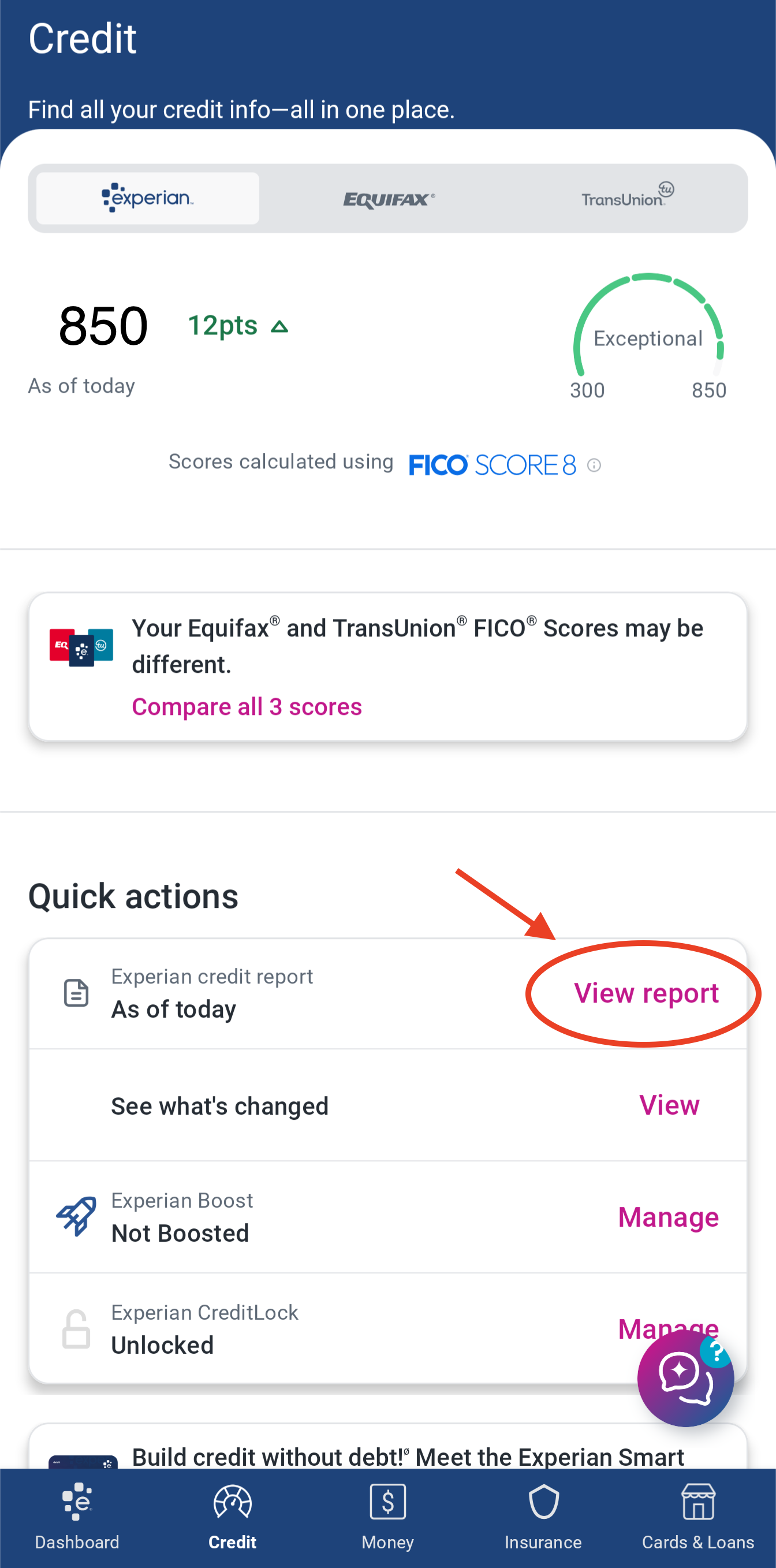

Step 4 - Open Your Experian Summary Page

On this next page you’ll scan down towards the middle of the page and look for the “View Report” link.

Tapping on this link will get us closer to seeing your actual Experian credit report listing all your cards and other open accounts, but still one more step to go before that…

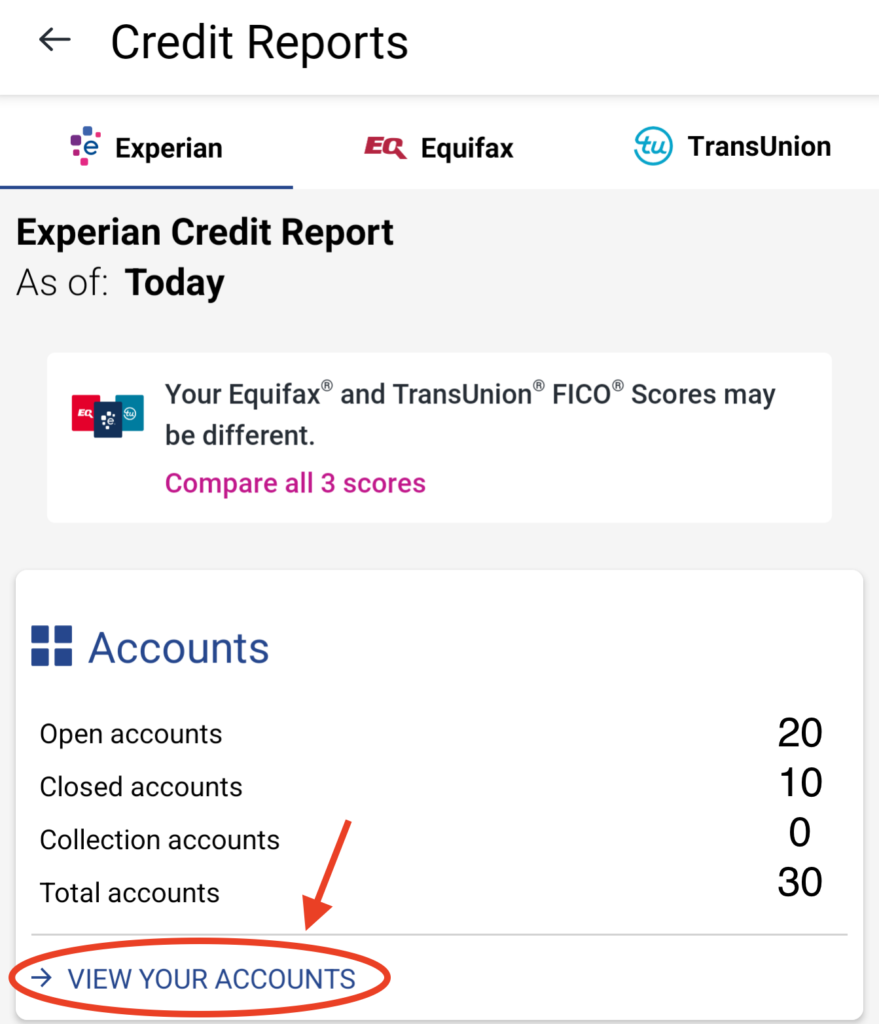

Step 5 - View Your Experian Credit Report

Man, what a journey. I bet you feel like Frodo right now trudging through the … shoot, I dunno, swamps? Bogs? … Wherever he trudged to get to that volcano place…

I digress.

This is finally the section that’ll lead us to the info we want to know for your 5/24 score.

Tap on that ‘View Your Accounts’ link and we’re almost home free. This will take you to the list of all your open credit card and other accounts.

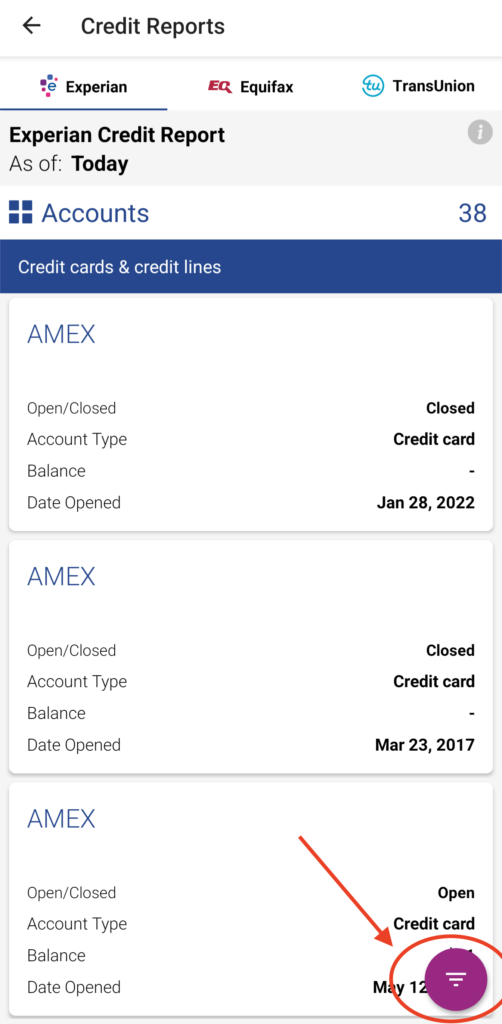

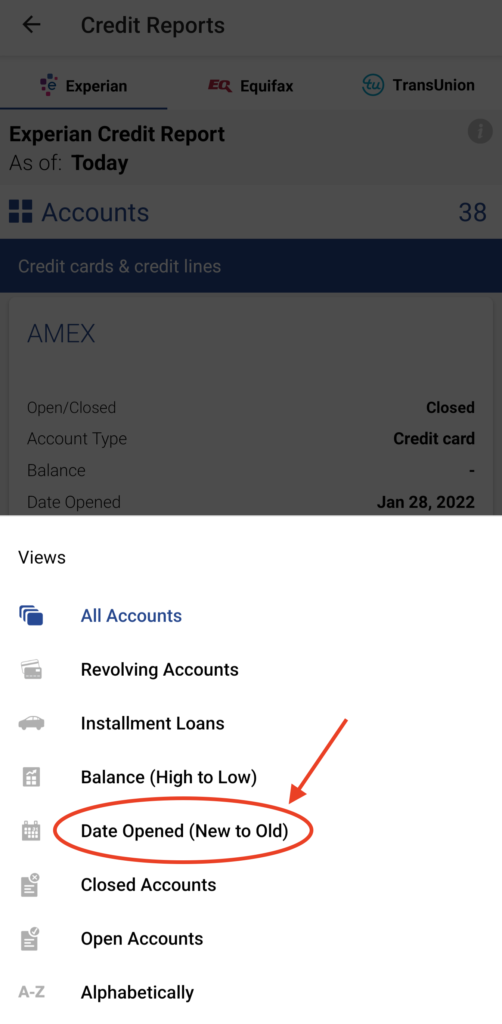

Step 6 - Filter Your Accounts

On the bottom right of the screen you should see a pink-colored little upside down triangle made up of horizontal lines.

Tap it.

Select the option to sort your accounts from ‘Newest to Oldest’.

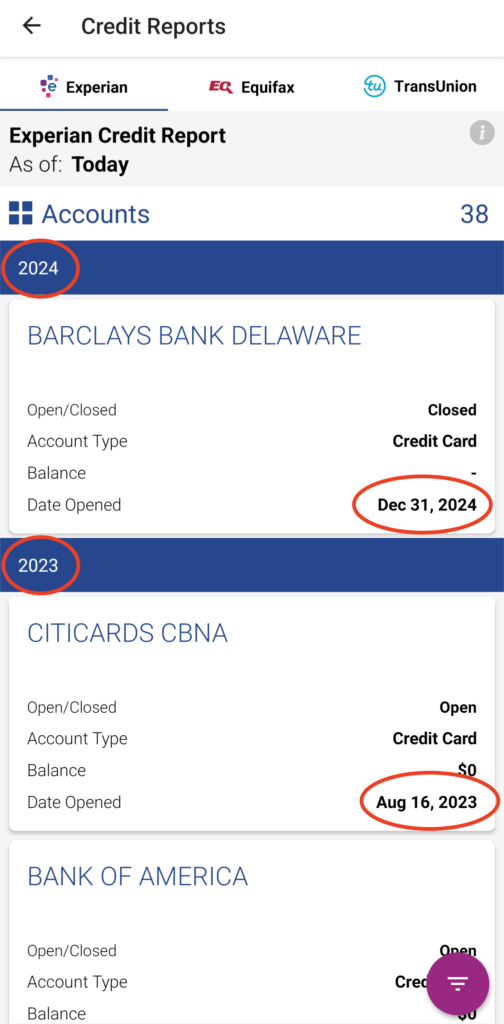

Step 7 - Start Counting Your Accounts

The moment you’ve all been waiting for!

There’s the section that lists your open accounts out by year so you can easily pinpoint that tricky 5/24 number.

Simply scroll through the list and add up each account that’s been opened from the date 2 years to the search date.

Important Considerations Impacting 5/24

Now, we’d like to be able to end it here on this one, but there are a few more pieces to this puzzle that you need to look out for:

- Closed Accounts May Still Count: Keep in mind that even closed credit card accounts within the last 24 months will still count towards your 5/24 status with Chase. While the Experian app primarily shows open accounts in the initial summary, you’ll need to dig deeper into your full credit report to see recently closed ones and their respective opening dates.

- Authorized User Accounts: Being an authorized user on someone else’s credit card does not count towards your 5/24 status, but the bank’s automated systems will think it does. To know if you’ll be considered over or under 5/24, just assume your AU cards count towards your number. If an AU card is the one that pushes you over 5/24, a quick call to recon after submitting your application should be able to clear it up and get it removed.

- Business Cards: Most business credit cards from major banks typically do not count towards your 5/24 limit. However, some issuers’ business cards do. Based on available datapoints we’ve seen, Capital One (with the exception of the Spark Cash Plus and the Venture X Business), some Citi biz cards, and Discover biz cards will report to personal credit reports, so be careful with these applications!

- Experian’s Data: While generally reliable for this purpose, Experian’s reporting might have occasional discrepancies. If you’re very close to the 5/24 limit and planning a crucial application, it’s always a good idea to double-check with your own records.

Getting to the Point(s)

Keeping tabs on your 5/24 status is a crucial part of a successful points and miles strategy, especially if you have your sights set on valuable Chase cards. The Experian app offers a remarkably convenient and quick way to get a good understanding of where you stand. So, next time you’re strategizing your next credit card application, take a few minutes to check your Experian app – it could save you from a potential denial and keep you on the path to your travel goals!