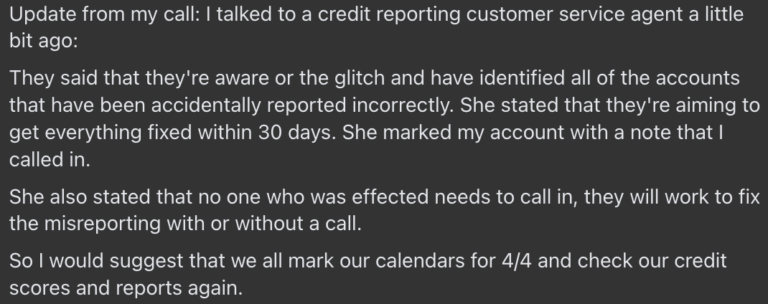

[UPDATE 3/4/2025]

thePointsPage Community has seen quite a few posts on this topic since the posting of this article, and one in particular is sticking out (in a good way).

This member was able to get in touch directly with another Chase rep who seemed to have the inside scoop on the situation, and was kind enough to answer OP’s questions about the ordeal. Read the post here below, or directly on our FB Community page:

The past few days have been frought with speculation about how Chase will now be reporting our beloved Ink business cards to personal credit files. Ouch.

We’ve had some ups and downs on this, but if finally looks like the braintrust is at a cosensus, and it’s better than we’d hoped for!

What You Need To Know

Just a few days ago we started seeing rumblings on Reddit, fellow travel hacking websites, and comments in our own PointsPage Community on Facebook about how people were suddently starting to see their Chase business cards showing up on their personal credit reports.

Some members decided to call in directly to their dedicated Chase customer service rep to try and get to the bottom of this issue, and, unfortunately may have received some bad information that kicked this whole frenzy off…

They were informed that Chase had made an internal decision to no longer keep their business cards off of personal credit reports for approved applications, and that each new card would, in fact, be another nail in the 5/24 coffin that we strive to never seal shut.

Is it True? Are they Coming After our Personal Reports?

Well, maybe not… Just as fast as that initial customer service rep info started leaking out into the blogosphere, we received another piece of news from yet another Chase rep stataing “whoops, we coded something wrong, this never should have happened!”

I guess on one hand I’m happy to hear that it seems to really just be an honest mistake, but on the other hand….WHAT?! How could that even happen without willfull intent?

I think it’s safe to say at this points that we’re ok for the time being, and to continue on as usual, but be aware that things in this hobby can change quickly with little to no warning at all.

What If the Business Cards are Already on Your Report

I think most of us were able to make it out of this glitchy round unscathed so far, but not everyone was lucky. We’ve seen several reports of new inks showing up soon after being approved, and even inks and other business cards that were approved months or years ago actually popping up on a personal credit report (!!!).

Have no fear, there’s definitely a way to get this fixed. it just takes a little time and effort:

- Monitor Your Credit Reports: Keep a close eye on your personal credit reports from all three major bureaus (Equifax, Experian, and TransUnion). You can use free resources like AnnualCreditReport.com, or even apps like CreditKarma to get 2 out of 3 reports right from your phone at any time

- Document Any Issues: If you see your Chase Ink card reporting on your personal report, take screenshots and document the date you noticed it. This will be helpful to initiate and track the status of your dispute with that credit agency.

- Contact Chase Directly: If you have concerns, don’t hesitate to contact Chase customer service. They are aware of the issue and can provide updates on the correction process. Be polite but persistent.

- Remain Patient: Chase has stated they are actively working to resolve the glitch. While it can be frustrating, try to remain patient as they work to correct the issue.

- Follow up Consistently: Don’t let your complaint fall by the wayside. Demand (politely) that your particular issue be dealt with in a reasonable amount of time.

Getting to the Point(s)

The glitch certainly wasn’t the end of our proverbial world of points…this time… But I think it did give us all something to think about as we move forward through this fun hobby of ours: how high, how far, and how long do you want to take it?

If the answer is FARRRRRR, then having strategic plans in place based around earning and burning your stash is a must-have. Develop your short, mid, and long term travel goals and start thinking about how you’re going to specifically hit them before another big devaluation or “glitch” happens.

Need to talk to someone to help get you started on those short, mid, and long term golal strategies? Book a One-on-One with thePointsPage Team to talk through it all at your own pace. We’ve helped dozens of members identify these goals and got them set up on an actionable plan to turn their wants into once-in-a-lifetime trips! Except we make those once-in-a-lifetime trips happen a couple times a year…