[Updated March 1, 2025]

For savvy travelers, points and miles unlock a world of adventure. But unforeseen circumstances can disrupt even the most meticulously planned trips. Here’s where travel insurance steps in, offering a safety net for trip cancellations, medical emergencies, and other travel mishaps.

While some credit cards offer basic travel insurance benefits, these often come with limitations. Let’s dive into standard credit card coverages and explore where Squaremouth and Allianz, leading travel insurance providers, can bridge the gaps for a more comprehensive points & miles travel experience.

Standard Credit Card Coverages: A Solid Foundation, But Not a Fortress

As many of us do, we rely on our credit card insurance benefits for the sole reason that they’re included with our cards. But we typically don’t take the time to actually review what’s included, at what limits, and how we can actually trigger these coverages when on a trip. So, what are some of the standard coverages that we assume our cards provide? They’re usually benefits like:

- Trip Cancellation / Interruption Coverage: Reimburses non-refundable trip costs (sometime only up to an amount of what was booked directly with the card) if you need to cancel or reschedule due to covered reasons like illness or bad weather.

- Travel Delay Coverage: Offers compensation for meals and accommodations in case of covered delays.

- Baggage Delay / Loss Coverage: Provides reimbursement for lost or delayed checked baggage.

While these options cover the majority of issues that arise in travel, there can be plenty of hoops that you’ll need to jump through to ensure the coverage is triggered. And if you can’t jump through those hoops, you just may be out of luck with your claim.

What Specifically Does My Credit Card Cover?

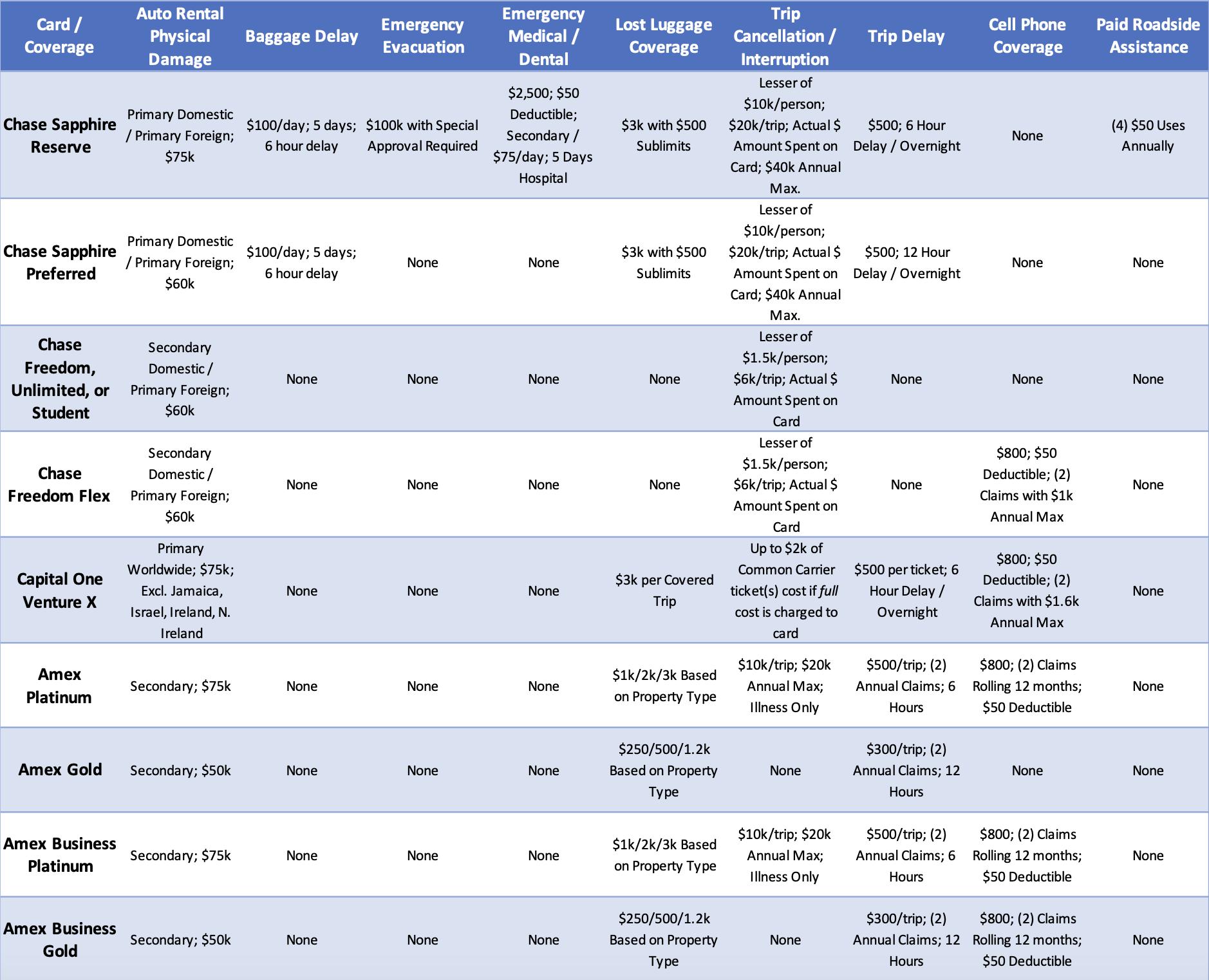

We’re not going to be able to explain all the nuances of the insurance coverages offered on your credit cards, but we can provide a general overview. The table below shows some of the most popular premium travel cards and limited detail to specific coverages that they either offer or they don’t.

We highly recommend you read through the benefits guide of your own credit card to understand the intricacies of coverage, exclusions, and conditions where coverage could apply. Below are quick links for some of the more popular cards.

For the Amex cards, scroll down the page to select the coverage you want to review, then select the specific card you’ll be booking with in the new page that opens. They don’t make it as easy as Chase or Cap1…

The Hidden Gaps in Credit Card Coverage

Now that we know the main basic coverages offered on credit cards, let’s dig in just a bit deeper to understand how they get “activated” at the start of your trip, as well as what needs to happen in order to file a claim against the policies offering them:

- Limited coverage for points bookings: Most credit card travel insurance applies only to trips booked directly with the card, or through the booking portal owned by that particular company. Since major insurance providers often have difficulties valuing point properly, they’ll sometimes restrict coverage to ancillary protections only (nominal per-diems instead of reimbursement of a cash value of the trip itself).

- Limited coverage amounts: Reimbursement caps for trip cancellation/interruption can be significantly lower than the total trip value, especially for high-value points redemptions.

- Exclusion of certain covered reasons: Some credit card policies exclude specific reasons for cancellation, such as job loss or change of travel plans. You’ll find this same issue in some non-credit card policies, but they’ll typically always give you the option to broaden coverage to include these things for a premium.

Squaremouth: A Tailored Solution for Points & Miles Travelers

To get past these limitations and obtain a full-coverage option, we look to services like Squaremouth. Rather than simply offer a singular, limited set of coverages like a credit card does, aggregators like Squaremouth offer comprehensive views into the travel insurance marketplace, specifically catering to points & miles travelers. Here’s what sets them apart:

- Focus on Points & Miles Bookings: In addition to the ancillary benefits like Trip Delay and Lost Baggage, Squaremouth’s comparison tool factors in the non-refundable costs associated with points bookings, ensuring your chosen policy adequately protects your valuable points investment. This means you’ll have the opportunity to assign a value to your points that you agree with.

- Extensive Coverage Options: Squaremouth allows you to compare policies with various coverages like trip cancellation/interruption, medical expenses, trip delay, baggage loss, dental expenses, evacuation, and more, enabling you to tailor your insurance to your specific needs.

- Transparent Comparison & Expert Guidance: Squaremouth doesn’t just show you quotes; it empowers informed decisions. They provide clear comparisons, unbiased policy analyses, and helpful articles, allowing you to select the best value policy for your points & miles trip.

- Trip-Specific Coverage Types: In addition to providing standard travel coverages for your next flight to Europe, Squaremouth also offers policies specific to Cruises and adventure sports (ski trips, for example).

- Single Trip vs Annual Policies: I personally prefer to purchase single-trip policies since the costs are so low with Squaremouth, but for those that want the simplicity of an annual policy you can book one here, too.

Beyond the Basics: Why Squaremouth Outshines Competitors

There are a few different aggregators you can use to search for similar results like with Squaremouth, so why do we recommend this one? Well, let’s see:

- Simple and Effective Interface: The user-interface used to search for and ultimately compare coverages from multiple insurance carriers can’t be beat. There aren’t any hidden menus, missing options, or convoluted ways to filter results. It’s just a simple, straightforward process to find you the best coverage.

- Zero Complaint Guarantee: This industry-leading initiative assures you’re buying from a reputable insurer known for fair claims handling. Squaremouth’s team of licensed claims adjusters advocates on your behalf if issues arise.

- Focus on Value: Squaremouth prioritizes finding you the best value policy, not just the cheapest. This empowers you to make informed decisions based on your budget and risk tolerance.

Allianz Annual Plans: Skip the Single Trip Coverage and get Insured for a Full Year

For points and miles travelers, maximizing value is key, and that extends to travel insurance, too. While single-trip policies from aggregators like Squaremouth definitely have their place, Allianz Annual Travel Insurance policies often offer a superior long-term strategy, especially for frequent flyers.

If you need a custom policy quote for an upcoming trip or for an annual policy, drop me an email with the subject “Insurance Quote Request” or set up a free Travel Insurance Consultation with me here.

Consider this: Each time you book a trip through Squaremouth, you’re investing time comparing quotes and purchasing a separate policy through a potentially different insurance carrier for each and every trip. Not a deal breaker by any means, but maybe not ideal considering you then have to learn about the new plan coverages, deductibles, waiting periods, and, most importantly, ease of claim handling.

This process can be cumbersome and add up in cost over the course of a year. With an Allianz annual policy, you’re covered for every trip you take within that year, no matter how long or short, eliminating the hassle of repeated searches and purchases. This streamlined approach is invaluable for those who chase last-minute deals, whose travel plans change frequently, or those with other household family members who you’d want to cover on the same annual plan.

Aren't the Allianz Annual Policies Better Coverage Anyway?

Not necessarily, but usually. There are factors to consider…

Beyond the convenience factor, Allianz annual policies can (but not always) offer more comprehensive coverage than many of the basic single-trip options offered through aggregators. While Squaremouth allows you to compare various plans, it can be difficult to truly compare apples-to-apples, and the cheapest option isn’t always the best.

These annual policies are designed with frequent travelers in mind, often including higher coverage limits for medical expenses, trip cancellations, and baggage delays – all crucial protections when you’re investing significant points and miles in your trips. Think about it: Would you rather risk your expensive award flight and meticulously planned itinerary on a bare-bones policy, or invest in the peace of mind that comes with a robust annual plan from a reputable provider?

For the savvy points and miles traveler, the answer is often a comprehensive annual policy that safeguards their travel investments year-round.

Getting to the Point(s)

Points & miles travel allows you to explore the world on your terms. Both Squaremouth and Allianz insurance policies ensure your investment is protected, freeing you to focus on creating lasting memories. Leverage their platforms to find a travel insurance policy that seamlessly complements your credit card coverage and safeguards your valuable points from unforeseen disruptions. Don’t let travel worries dim your points & miles adventures. Embrace the journey with confidence, knowing that you’re covered.

If you’d like to request a quote on an annual policy, you can email me directly at [email protected]. If you want to take a look at Squaremouth single-trip plans, click the banner below for more info.